Step 4: Where we are now

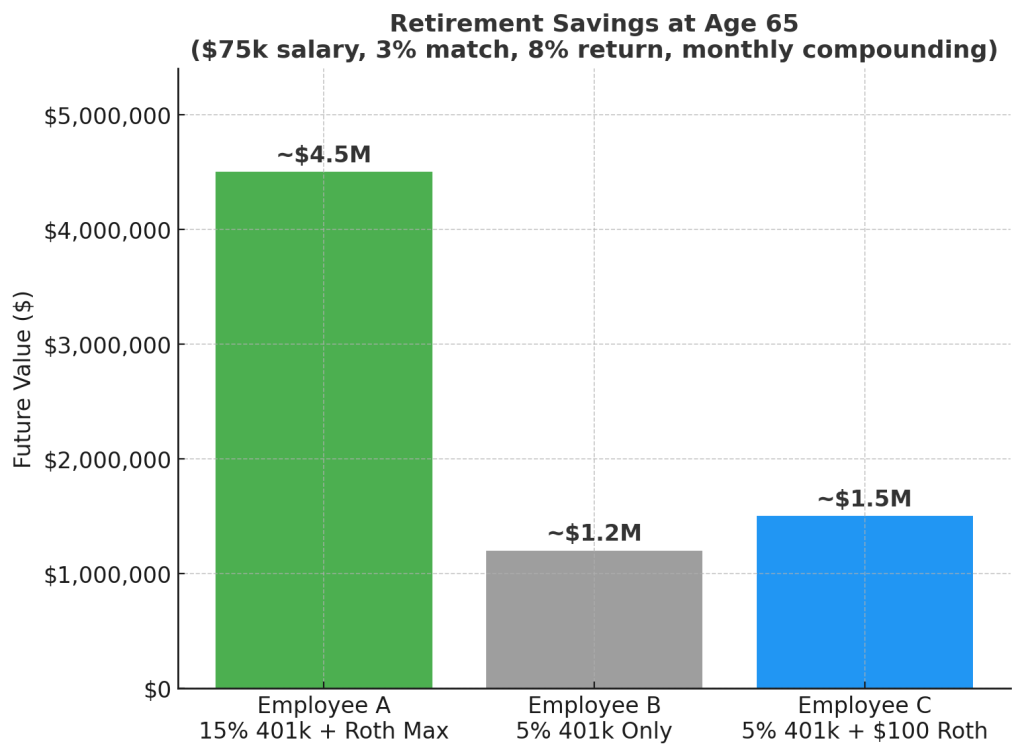

This chart shows three people, all 28 years old, all earning $75,000/year at the same job. The only difference? How they chose to invest.

- Employee A → Invests 15% ($11,250/year) into a 401k + employer match 3% ($2,250) + Roth IRA $7,000/year → ends with ~$4.5M

- Employee B → Invests only 5% ($3,750/year) into a 401k + employer match 3% ($2,250) → ends with ~$1.2M

- Employee C → Invests 5% ($3,750/year) into a 401k + employer match 3% ($2,250) + Roth IRA $100/month ($1,200/year) → ends with ~$1.5M

👉 Same job. Same pay. Same years worked. Completely different futures.

By Step 4, you’ve already done the hard work:

- Step 0: Got honest about where you stand financially.

- Step 1: Built your starter $1,000 emergency fund.

- Step 2: Paid off debt + saved a full 6-month emergency fund.

- Step 3: Started investing through your 401k (or solo plan if self-employed).

- Step 4: Added the Roth IRA to balance out future taxes.

At this point, you’re debt-free, investing in two vehicles (401k + Roth IRA), and building real momentum while others might still be stuck.

💡 On top of your retirement accounts, you’ve also built a great emergency fund in a high-yield savings or money market account. I personally park my project funds there too – things like home upgrades or big expenses. After maxing my Roth to paying my future self first, I let the rest of the year’s money sit there earning ~4% for the potential project. Once that is done, the money goes into another investment vehicle (which we will cover in the next step).

For example, if I build up $30k for an emergency fund (1 year) + $10k for projects, that’s $40k just sitting safely. One year later, it earns me $1,600 without lifting a finger – enough to buy hardwood flooring for 1 or 2 rooms (doing it myself), a couple of windows, or chip away at another project… all without lifting a finger. If I have left over funds from my project, that money is moved to a more aggressive, higher earning investment leaving my 1 year emergency fund for peace of mind. Every dollar has a place to grow.

This setup also gives me peace of mind. A strong base + safe reserves let me go more aggressive in my stock portfolio, because I know I’m covered if life happens.

✨ And here’s where it really clicks: your $4.5M retirement fund grows even more and doesn’t just stop at retirement. That number is just based on 2 investment vehicles. As you progress in your career, your income grows and so should your investments. You get married and your partner shares this mindset and now you are looking at potentially $7-$10million for retirement. Once you’re secure, you shift into a new mindset – building generational wealth.

That means passing down financial wisdom, security, and opportunity to your kids and grandkids. In later posts, I’ll be sharing stories of families who built wealth by keeping money within their household. Instead of relying on banks, they borrowed against their own investments and paid themselves back-growing their wealth over time and avoiding high taxes.

That’s the power of the Simplified Roadmap: one step at a time, you go from surviving… to thriving… to leaving a legacy.

Leave a comment